Singapore has maintained its top position in the ‘Ease of Doing Business’ report according to the World Bank for 7 years running. From company incorporation to realization of profits and expansion of markets, Singapore offers seamless execution of business at all stages.

In this comparative report, we look at the differences between setting up a company and doing business in Singapore and in India.

| World Bank’s Doing Business (DB) 2014 Singapore vs. India |

||

| Rank | ||

| Measure | Singapore | India |

| Overall ranking | 1 | 134 |

| Starting a business | 3 | 179 |

| Dealing with construction permits | 3 | 182 |

| Getting electricity | 6 | 111 |

| Registering property | 28 | 92 |

| Getting credit | 3 | 28 |

| Protecting investors | 2 | 34 |

| Paying taxes | 5 | 158 |

| Trading across borders | 1 | 132 |

| Enforcing contracts | 12 | 186 |

| Resolving insolvency | 4 | 121 |

Company Incorporation

Singapore’s company incorporation processes make it easier for businesses to get their businesses started. Compared to India, where it takes 27 days on average to start a business, it takes about 1 – 2 days in Singapore is to incorporate a company.

Corporate tax rate

Singapore is a republic with a politically stable government that encourages foreign investments. Among the various incentives offered to stimulate investments is its corporate tax rate. The South East Asian nation’s corporate tax rate is one of the most attractive in the world.

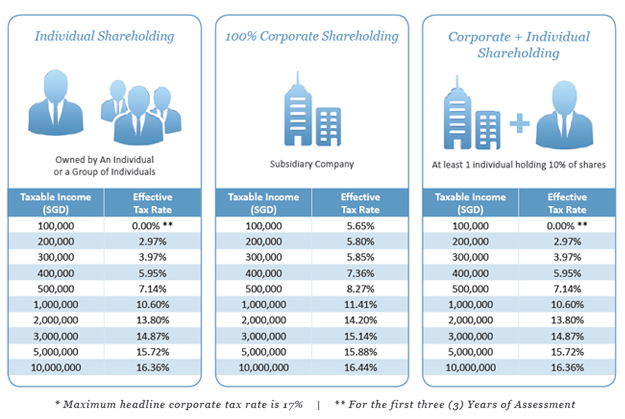

Singapore has a marginal corporate income tax rate of 17%. However, for newly incorporated companies, the start-up tax exemption (SUTE) scheme makes the effective corporate tax rate below 9% for annual profits of up to S$300,000.

Singapore’s corporate tax rates under the SUTE scheme

*Qualifying conditions apply

To qualify for full tax exemption, the following conditions must be met by companies:

- Registered in Singapore

- Tax resident in Singapore for the YA

- Has no more than 20 shareholders during the YA where

- All shareholders are individuals holding shares in their own names OR

- At least 1 shareholder is an individual holding at least 10% of the company’s ordinary shares

- Investment holding companies and companies engaged in property development activities are entitle to partial Exemption only.

Singapore’s corporate tax rates after 3 years of full tax exemption

India corporate tax rates

On the contrary, the corporate tax rate in India is pegged at 30% for residents and 40% for non-residents. According to the World Bank’s latest report on ease of doing business, the total tax rate in India can be as high as 62.8% and there are as many as 33 payments under the head of profit, labor and other taxes.

Paying Taxes In India, per the World Bank 2014 Doing Business report

| Tax or mandatory contribution |

Payments (number) |

Total tax rate (% profit) |

| Corporate income tax | 1 | 20.6 |

| Social security contributions | 12 | 15.4 |

| Central Sales Tax | 1 | 14.1 |

| Employee’s state insurance contribution | 12 | 5.4 |

| Dividend tax | 1 | 3.7 |

| Property tax | 1 | 3.3 |

| Tax on insurance contracts | 1 | 0.2 |

| Total | 62.8 |

Foreign investment friendliness

The Singapore government offers numerous incentives for foreign businesses to set their shop in the city-state. Singapore supports an open trade policy and there are very few barriers to external trade transactions. The World Economic Forum’s 2014 Global Enabling Trade report ranked Singapore at the top position due to its trade-friendly regulations and a business-enabling environment. India, in comparison, stood at the 96th place.

A new company is required to provide a minimum paid-up capital of only S$1.00 in Singapore compared to INR 100,000 in India. Small companies with an annual turnover of less than S$5 million are exempt from audit requirements before filing annual returns. In India, every company has to comply with audit requirements.

In addition, while Singapore offers 100% foreign direct investment in all the business sectors, India places a cap on foreign ownership in certain sectors.

Intellectual Property protection

Protection of Intellectual Property (IP) rights is a crucial element responsible for gaining confidence of foreign investors. According to the World Economic Forum’s Global Competitiveness Report 2013-2014, Singapore stands second in the world and first in Asia for having the best IP protection. The Political & Economic Risk Consultancy Report 2011 and the International Property Rights Index 2012 have similarly ranked Singapore’s IP protection as the top in Asia. The Global Competitiveness Index (GCI) ranks India at the 71st position.

| WEF’s Global Competitiveness Index (GCI) Singapore vs. India |

||

| Rank | ||

| Measure | Singapore | India |

| GCI 2013–2014 | 2 | 60 |

| Basic Requirements (60%) | 1 | 96 |

| Institutions | 3 | 72 |

| Infrastructure | 2 | 85 |

| Macroeconomic environment | 18 | 110 |

| Health and primary education | 2 | 102 |

| Efficiency Enhancers (35%) | 2 | 42 |

| Higher education and training | 2 | 91 |

| Goods market efficiency | 1 | 85 |

| Labor market efficiency | 1 | 99 |

| Financial market development | 2 | 19 |

| Technological readiness | 7 | 98 |

| Market size | 34 | 3 |

| Innovation and sophistication factors (5%) | 13 | 41 |

| Business sophistication | 7 | 42 |

| Innovation | 9 | 41 |

Dynamic workforce

Singapore offers a highly-educated and skilled workforce and has a work visa framework to facilitate the employment of workers from overseas. The GCI ranks Singapore at the top position for ‘Labour Market Efficiency’ and ranked India 99th for the same indicator. In addition, Singapore has signed the CECA with India, which facilitates the inflow of talent from India into Singapore.

In a Nutshell

The above analysis confirms that India with its very high corporate tax rates, which can be as high as 62.8%, lags far behind Singapore in attracting foreign investors to its shores. Additionally, virtually non-existent IP protection laws, bureaucratic hurdles, hard-to-get environmental clearances, and out-dated labour regulations, all combine to push India well behind Singapore in the annual Ease of Doing Business Index published by the World Bank.

Read More » Doing Business in India or Singapore

Incorporate a company in Singapore quickly and easily

Singapore Company Incorporation is the leading force in company registration in Singapore. With a gamut of services including Work Visas & Relocation, Accounting & Taxation, Business Licenses, Company Secretary and Trademark Registration, we are well-positioned to support your business.