Singapore will be celebrating 56 years of its modern existence next year. And what a journey it has been!

Half-a-century of political stability led to many economic milestones; with the city-state’s business environment and economic fundamentals including the labour policies, legislations, and infrastructure, winning numerous accolades and has incorporated businesses over the years.

Most notable is the honour of being the best country in the world for doing business seven years in a row. (World Bank’s Doing Business reports)

Now, Singapore is one of the busiest ports in the world, a leading oil refining and distribution center, the manufacturing hub for electronic components, and a vibrant financial and business incorporation hub in Asia.

Also, as the world enters a new era, the nation is upgrading investments in new growth industries such as interactive and digital media, biomedical sciences, and clean and green technology.

Related Reading: Why Choose Singapore For Business

A Comprehensive Guide on the Benefits of Incorporating a Singapore Company

Singapore’s Ranking in Various Indices

Most notably, in technological innovation and intellectual rights protection, Singapore progress is noted by its third rank in the International Property Rights Index 2020, #1 rank in Asia in the Global Innovation Index 2020, and being the only Asian country to make the top 10 list of the World Economic Forum’s Global Competitiveness report.

Most notably, in technological innovation and intellectual rights protection, Singapore progress is noted by its third rank in the International Property Rights Index 2020, #1 rank in Asia in the Global Innovation Index 2020, and being the only Asian country to make the top 10 list of the World Economic Forum’s Global Competitiveness report.

The above is due to Singapore’s Government emphasis on:

R&D – the spending on developing R&D will reach 3.5% of GDP by 2015. As of now, nearly 1% of the country’s workforce are scientists and engineers. Singapore has also established five research centres of excellence in local universities to nurture and encourage indigenous inquisitive minds.

IP protection – the country has ensured that IP and copyright laws are in synergy with the global laws on IP protection, as it grants increased public access to intellectual property.

Read More » Singapore as the Digital Capital of Asia

A Leading Financial Hub in Asia

According to the Global Financial Centres Index Survey 2013, Singapore is the world’s fourth-ranked financial centre in terms of competitiveness. The wide range of products and services offered here include banking, foreign exchange, bonds, equities, derivatives, asset management and insurance; with private banking, risk and wealth management identified as future growth areas. The country also hosts some of the world’s leading names in insurance broking, offshore insurance, captive and risk management.

According to the Global Financial Centres Index Survey 2013, Singapore is the world’s fourth-ranked financial centre in terms of competitiveness. The wide range of products and services offered here include banking, foreign exchange, bonds, equities, derivatives, asset management and insurance; with private banking, risk and wealth management identified as future growth areas. The country also hosts some of the world’s leading names in insurance broking, offshore insurance, captive and risk management.

So much so that with total assets under management of around S$1 trillion, the city-state is reconsigned as the premier asset management centre of Asia. It also has the world’s fourth-largest foreign exchange market, Asia’s second-largest over-the-counter derivatives trading centre, and is one of the region’s leading commodities derivatives hub.

The Singapore Exchange (SGX) – the first integrated cash and derivatives exchange in the Asia-Pacific – with over 200 global companies listed in it, has a varied product range including exchange-traded funds, single stock, and bond futures. With a liberalized banking sector, Singapore’s domestic financial sector has become more robust amidst global competition.

Benefits of Registering a Company in Singapore

With some 26,000 international companies (of which around 7,000 are multinationals), the advantages of incorporating a company in Singapore are obvious.

With some 26,000 international companies (of which around 7,000 are multinationals), the advantages of incorporating a company in Singapore are obvious.

Apart from the city-state’s 75 comprehensive double taxation agreements and 8 limited treaties dealing with income from shipping and air transport enterprises, as well as no controlled foreign company rules, no capital gains tax, and one of the lowest corporate tax rates in the world; many foreign entrepreneurs and companies are drawn to Singapore due to its relatively low business costs. (compared to other Asian destinations such as Hong Kong and Tokyo)

Thus, whether you are an international company wanting to set up an Asia-Pacific base, or an Asian company wanting to access markets in Europe and US, Singapore is the place to be.

How to Incorporate a Company

All businesses (may be an individual, firm or a corporation carrying out economic activities for a foreign company) in Singapore are required to be registered with ACRA (Accounting & Corporate Regulatory Authority).

All businesses (may be an individual, firm or a corporation carrying out economic activities for a foreign company) in Singapore are required to be registered with ACRA (Accounting & Corporate Regulatory Authority).

If you are a foreign company looking to incorporate a Singapore subsidiary or a holding company (which essentially will be a private limited company), you need to appoint two local agents (residents) to act on your behalf. They may be Singapore citizens, permanent residents, or foreigners with employment or dependent passes.

Do note that some businesses such as banking, insurance, stock broking, and manufacture of goods such as cigars and firecrackers, may need special licenses from various government authorities.

Work Visas in Singapore

Firstly, Singapore has a decent pool of English-speaking highly educated, highly motivated, and highly productive local workforce, which is constantly looking to upgrade their skills and knowledge. Moreover, the country has several world-class universities nurturing talent in engineering, technology, and other sciences year after year.

Secondly, Singapore follows an open immigration policy to enhance the country’s talent pool. Such foreigners who have a job offer from a Singapore company and possess suitable qualifications need to get work visas approved by the Singapore’s Ministry of Manpower (MOM) before they start working. These work visas may be either work permit, S Pass or an Employment Pass, which is most preferred work visa among experienced professionals, managerial personnel, and executives. Other options are securing an EntrePass or a Personalised Employment Pass.

Secondly, Singapore follows an open immigration policy to enhance the country’s talent pool. Such foreigners who have a job offer from a Singapore company and possess suitable qualifications need to get work visas approved by the Singapore’s Ministry of Manpower (MOM) before they start working. These work visas may be either work permit, S Pass or an Employment Pass, which is most preferred work visa among experienced professionals, managerial personnel, and executives. Other options are securing an EntrePass or a Personalised Employment Pass.

Moreover, if a company in Singapore needs a specialist or a manager to come for a short-term project, work visa approvals are granted in no time.

Wage Policies in Singapore

While Singapore has no minimum wage law, the National Wages Council with representatives from the government, employers and unions, formulates wage guidelines periodically.

There is also the National Trades Union Congress (NTUC) – the only employee trade unions federation in the country, which is mandated to protect the workers interests in the country.

As there is no minimum wage rule in Singapore, an employee’s salary is subject to negotiation and mutual agreement between the employer and the employee. However, an employer who intends on hiring foreign employees must consider the minimum salary requirements applicable to qualify for the various work visas.

As there is no minimum wage rule in Singapore, an employee’s salary is subject to negotiation and mutual agreement between the employer and the employee. However, an employer who intends on hiring foreign employees must consider the minimum salary requirements applicable to qualify for the various work visas.

Notably, Singapore has two statutory requirements for employers as regards to their contribution per employee – the Central Provident Fund (CPF) contributions, and the Skills Development Levy (SDL).

CPF, payable to Singapore citizens and permanent residents, is determined according to the rates set out in the CPF Act and are based on the employee’s actual salary earned for that month. The employer may deduct the employee’s share from his salary.

SDL, which is used to fund the Skills Development Fund which supports workforce upgrading programmes and provides training grants to employers, is to be paid by the employer for all employees. The rate is 0.25% of an employee’s gross monthly remuneration up to the first $4,500, or $2, whichever is higher. If the employee’s gross monthly remuneration is more than $4,500, the SDL is fixed at $11.25. The SDL must be paid by the employer and cannot be deducted from the employee’s salary.

Taxation in Singapore

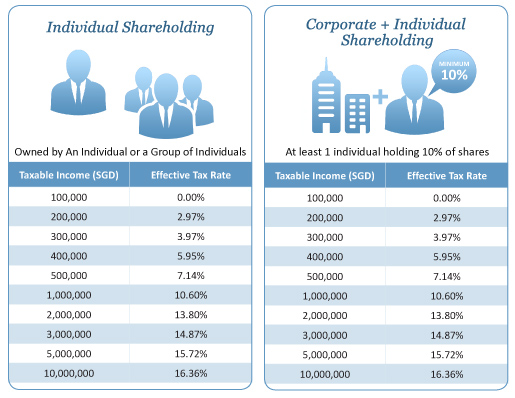

As regards to corporate tax, the system prevalent in Singapore is called a one-tier corporate tax system, under which tax paid by a company on its chargeable income is the final tax. It’s rate since 2010 has been fixed at 17%. It is calculated on the basis of the company’s chargeable income i.e. taxable revenues less allowable expenses and other allowances.

As regards to corporate tax, the system prevalent in Singapore is called a one-tier corporate tax system, under which tax paid by a company on its chargeable income is the final tax. It’s rate since 2010 has been fixed at 17%. It is calculated on the basis of the company’s chargeable income i.e. taxable revenues less allowable expenses and other allowances.

But the effective tax payable comes out to even lower if one takes advantage of all the government incentives, subsidies and schemes. Some examples are the Corporate Income Tax (CIT) rebate, Productivity and Innovation Credit (PIC) Scheme, tax exemption for start-ups eligible for the Start-up Tax Exemption (SUTE) scheme, and the foreign-sourced Income Exemption scheme (FSIE).

Moreover, there is no capital gains tax or estate taxes to worry about in Singapore.

Effective Corporate Tax Rate with Full Exemption (click for larger view)

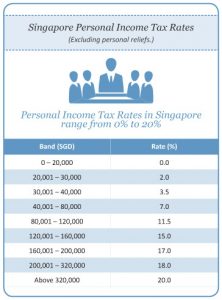

As regards to the personal tax, it is levied on a progressive rate which starts at 0% and is capped at 22%.

As regards to the personal tax, it is levied on a progressive rate which starts at 0% and is capped at 22%.

The eligibility for being treated as a tax resident in Singapore includes:

- a citizen or a permanent resident residing in Singapore except for temporary absences; or

- a foreigner who has stayed/worked in Singapore (excludes director of a company) for 183 days or more in the year before the year-of-assessment

Grants for Singapore Companies

Singapore companies in need of funding have a plethora of traditional sources such as banks, venture capitalists, financial houses, and private funds. To add to it, the Singapore Government also provides funding to both Singaporean and foreign companies.

For this, government-led organisations such as Action Community for Entrepreneurship (ACE), SPRING Singapore – a statutory board of the Ministry of Trade and Industry, and the Economic Development Board take the lead.

For this, government-led organisations such as Action Community for Entrepreneurship (ACE), SPRING Singapore – a statutory board of the Ministry of Trade and Industry, and the Economic Development Board take the lead.

Few examples of government assistance are the micro-loan programmes, loan insurance scheme, Start-up Enterprise Development Scheme (SEEDS) and Local Enterprise Finance Scheme (LEFS) offered by SPRING Singapore.

Companies incorporated in Singapore can also take advantage of the Innovation and Capability Voucher (ICV) scheme and apply for vouchers each valued at $5,000 for redemption of professional consultancy services, hardware and technical solutions.

In addition, the EnterpriseOne Portal offers a comprehensive list of government assistance schemes for various purposes, from training subsidies and technology upgrades to improving work-life balance among your employees.

Related Reading » Singapore To Attract Businesses

Incorporate a company in Singapore quickly and easily

Singapore Company Incorporation is the leading force in company registration in Singapore. With a gamut of services including Work Visas & Relocation, Accounting & Taxation, Business Licenses, Company Secretary and Trademark Registration, we are well-positioned to support your business.