In the wake of horrific terrorist attacks occurring throughout the globe, concerns about money laundering and its relationship with terrorism have pressured the global economy to take action. How will this impact companies in Singapore?

As one of the most dynamic financial centres in the world, Singapore is home to some 286,373 Singapore companies (excluding 144,034 sole proprietorships, 20,632 partnerships, 14,103 limited liability partnerships and 196 limited partnerships). While this is a testament to the island-state’s attraction as an investment destination, it also leaves Singapore vulnerable to potential exploitation by money launderers, given the sheer volume of financial transactions that take place on a daily basis.

War Against Money Laundering

Infographic: Money Laundering

The term “money laundering” basically refers to a process whereby funds obtained via illegal means are “cleaned” through seemingly legitimate transactions, before being funneled to their beneficial owners. In most instances, a company serves as a convenient vehicle for money launderers to channel their ill-gotten gains through, to avoid detection and confiscation by the authorities.

The Financial Action Task Force (“FATF”) has been at the forefront of the war against money launderers since its establishment in 1989 at the G-7 Summit in Paris. As a member of the FATF since 1992, Singapore is committed towards combating money laundering and implementing measures to mitigate against the risk that companies incorporated in Singapore are being utilised as convenient vehicles for money laundering activities.

A More Stringent Screening Process

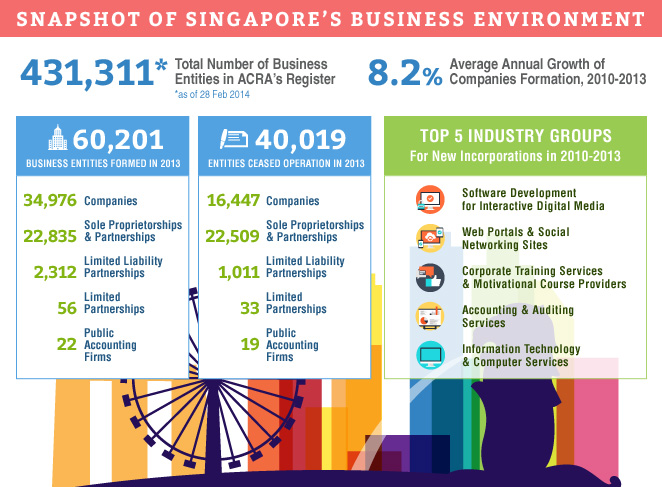

Singapore is unique for many reasons, with its attractive corporate tax rates, pro-business government policies, strategic location, first-world infrastructure and population of highly skilled and bilingual workforce making it one of the top choices for foreign investment. In 2013 alone, an estimated 60,201 companies were incorporated – the troubling statistic is that in the same year, 40,019 companies ceased operation .

Given how quickly a setting up a company in Singapore – the World Bank’s survey of 189 economies across the globe ranked Singapore no. 1 for the ease in which entrepreneurs can start up a business in Singapore, estimating that it only took an average of two and a half days to set up a business; Singapore is naturally an attractive target for money launderers who wish to quickly set up the company, funnel their ill-gotten gains and get out. This vulnerability was highlighted in the Singapore National Money Laundering and Terrorist Financing Risk Assessment Report 2013 published by the Monetary Authority of Singapore (“MAS”) .

Bearing this in mind, MAS and the Accounting and Corporate Regulatory Authority (“ACRA”) have been jointly tasked with regulating corporate service providers (“CSPs”) who provide incorporation services for companies; as well as banks and financial institutions, who can monitor large and suspicious transactions moving in and out of a company’s accounts.

As part of the enhanced screening process, CSPs are now obliged to ensure that adequate measures are in place to screen potential clients, before agreeing to provide incorporation services. Examples of such measures include, but are not limited to:

As part of the enhanced screening process, CSPs are now obliged to ensure that adequate measures are in place to screen potential clients, before agreeing to provide incorporation services. Examples of such measures include, but are not limited to:

- Requesting for identification proof from their clients;

- Requesting for identification proof of all directors, shareholders and ultimate beneficial owners (“UBOs”) of the company

- Proposed business activities of the company

- Signed declaration that the client is not a Politically Exposed Person (“PEP”)

An Ultimate Beneficial Owner (“UBO”) will be the individual(s) who ultimately benefit from the company and is not the same as the holding company or parent company, while a PEP is an individual who has been entrusted with a prominent public function by a government or international organization. Due to their position, influence and the tendency for governments to relax their immigration policies for PEPs, there are many opportunities for them to abuse their privileges for money laundering.

In addition, CSPs would also have to conduct due diligence exercises on their existing portfolio of clients, as CSPs typically also offer other corporate services such as ongoing statutory compliance, preparation of Directors’ Resolutions, etc., to companies. Examples of such measures would include, but are not limited to:

- Updating their records to ensure that the client’s information is current and not outdated, particularly if identification proof has expired;

- Establishing contact with the client or requesting for face-to-face meetings;

- Reviewing unusual corporate transactions

- Reviewing unusual or overly complex company structures

Similarly, banks and financial institutions may do likewise – in fact, banks and financial institutions may be even more stringent, as they may question irregular large transactions or unusual patterns of transactions.

How will this impact my Singapore-incorporated company?

These new changes have far-reaching implications across the industry, not only for business owners who have yet to incorporate their company, but also for business owners of existing companies.

For business owners that have yet to incorporate their company, it may be more prudent to consult a CSP before proceeding with the incorporation process. By doing so, the business owner(s) can anticipate what documentation is required (there may be additional documentation other than those listed above) and adjust their expectations accordingly.

For business owners that have yet to incorporate their company, it may be more prudent to consult a CSP before proceeding with the incorporation process. By doing so, the business owner(s) can anticipate what documentation is required (there may be additional documentation other than those listed above) and adjust their expectations accordingly.

When choosing a Corporate Service Provider, business owners should pay attention to the following:

- Does this CSP have established procedures in place?

- Is the CSP knowledgeable on the latest changes in the industry?

- Is the CSP over-promising? (e.g. offering to incorporate the company in a few hours etc.)

Business owners should bear in mind that under the new regulatory regime, CSPs found to be non-compliant with ACRA’s guidelines (i.e. they have no procedures in place to screen clients or proceed to incorporate companies blindly) can potentially have their licence revoked. Once a CSP’s licence is revoked, the CSP will then be unable to assist its clients to make lodgements or notifications to ACRA via its online Bizfile system.

Indeed, while it may be tempting to go with a CSP who is extremely co-operative and willing to make things easier by turning a blind eye, business owners should bear in mind that it is not worth the stress or anxiety when ACRA decides to audit the said CSP and finds it lacking, which could have substantial consequences on all of the CSP’s clients.

Similarly, companies that already engage a CSP should pay attention to the same – having a CSP that is competent, regularly updated and fully aware of changes in regulations in the industry will benefit all of its clients and ensure that it is not an unwitting party to money laundering activities.

At the end of the day, companies may find that making the switch from their current CSP to a more established, experienced CSP may be slightly more costly, but as regulations continue to tighten and ACRA begins to audit CSPs, it would be prudent for companies to ensure that they are in safe hands as soon as possible, rather than remaining complacent.

Unhappy with your current corporate service provider?

Consider switching to Singapore Company Incorporation.

Contact us now for a free quote!

Singapore and The Changing Global Economy

Essentially, it is not just Singapore, but the entire global economy that is sitting up and taking notice of the socio-economic impact of money laundering – after all, money laundering is also deeply connected to as illegal arms sales, drug trafficking, prostitution rings, smuggling, embezzlement, fraud schemes, etc., which exploit innocent people around the world.

The Organisation for Economic Co-operation and Development (“OECD”) is an international organisation dedicated to democracy, economic development and the market economy. As a member of the OECD, Singapore has to-date, successfully negotiated and signed Double Taxation Agreements (“DTAs”) with 76 other countries, facilitating cross-border investments and other economic activities.

However, the OECD, which also surveys factors such as each nation’s transparency, does require its members to meet certain obligations and standards, in line with the challenges that OECD anticipates should be addressed. On 6 May 2014, the OECD declared the introduction of the Automatic Exchange of Information (“AEOI”) standard, which aimed to promote transparency amongst its member countries.

Clearly, the global economy as a whole is moving towards a more transparent world – as such, investors globally will now have to anticipate and accept the additional time, effort and costs involved. That said, it cannot be denied that these changes are long overdue and will hopefully discourage money laundering and its related illegal activities.

Related Reading » Company Incorporation Singapore

Ready to start a company in Singapore?

You may also call us at +65 6850 5280 for a free consultation.Contact Us