Most Singapore private limited companies will now not need to do audit. Currently, a company must be audited unless:

- It is a dormant company, or

- It is an exempt private company (EPC) with annual revenue of $5 million or less. EPC is defined as a private company with not more than 20 members

and having no corporate shareholder

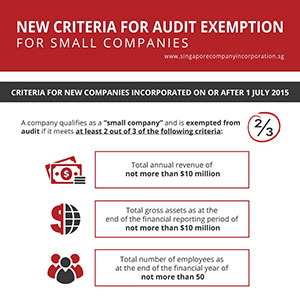

The Singapore Companies’ Act governing all companies incorporated in Singapore has introduced a new “small company” criterion for exemption from statutory audit. A company qualifies for audit exemption as a “small company” if it has at least 2 of the following:

- Total annual revenue of not more than $10 million

- Total gross assets as at the end of the financial reporting period of not more than $10 million.

- Total number of employees as at the end of the financial year of not more than 50.

Companies who are part of a small group of companies can also qualify if it meet at least two of the following conditions:

- aggregate turnover must be not more than SGD 10 million

- the aggregate balance sheet total must be not more than SGD 10 million at the end of the financial reporting period

- the aggregate average number of employees must be not more than 50 at the end of the financial reporting period

Related Reading » A Simple Guide on Audit Exemption in Singapore

Need help with your Unaudited Report?

We are constantly kept abreast of Singapore’s regulatory compliance requirements. Engage our compliance specialists today to fulfil your business needs.