Singapore’s strong diplomatic policy has led to the establishment of at least 76 double taxation agreements, which companies can benefit from when making multinational transactions. We explain what a Certificate of Residence (“COR”) is, and how it works.

In this increasingly globalised world, companies are becoming more ambitious and recognise that they need to look beyond the domestic border to expand their market reach and achieve higher profits.

Certificate of Residence in Singapore

Strategically situated in the Asia-Pacific region, Singapore aims to be the ideal launchpad for companies that wish to target the Asia-Pacific market; and the Singapore government has made substantial efforts to establish strong diplomatic ties with its neighbours and other dynamic financial centres, which in turn has made it much easier for locally incorporated companies to widen their market reach into the region.

A key achievement of Singapore’s strong diplomatic policy is the establishment of double taxation agreements (“DTAs”) with 76 other countries all over the world. With a DTA, tax barriers are minimised, incentivising cross-border flows of trade, investment and expertise between two countries. More importantly, a DTA allows taxpayers to enjoy certainty on the tax regime of either country while eliminating double taxation. Given that Singapore has an extremely attractive tax regime as compared to its peers throughout the world, this is not only beneficial for locally incorporated companies as they eliminate tax from profits earned in the foreign country while gaining access to that foreign market, but also potentially beneficial for foreign-owned companies, who may prefer Singapore’s low corporate tax rate as compared to their own domestic tax rate. Naturally, the benefits of a DTA and Singapore’s corporate tax rate are only applicable to companies that are considered to be Singapore tax residents, a classification that is not necessarily derived from a company’s place of incorporation.

Singapore Tax Resident

Generally, a company is considered to be a tax resident in Singapore when the control and management of the company is based in Singapore. Hence, if a company were to run the bulk of its business operations in Singapore; and have most of its employees in Singapore, but have its management office situated in Indonesia, it would not fulfil this criteria. This is a common scenario that arises for franchisees or retail stores.

Generally, a company is considered to be a tax resident in Singapore when the control and management of the company is based in Singapore. Hence, if a company were to run the bulk of its business operations in Singapore; and have most of its employees in Singapore, but have its management office situated in Indonesia, it would not fulfil this criteria. This is a common scenario that arises for franchisees or retail stores.

The determination of a company’s tax residency is governed by the Inland Revenue Authority of Singapore (“IRAS”). As part of its assessment of the “control and management”, IRAS also takes into consideration if the following business functions are carried out in Singapore:

- Decision making on strategic matters, e.g. company policy and strategy

- Location of the company’s Board of Directors’ meetings

- Any other essential business functions crucial to the running of the company’s business operations

For foreign-owned investment companies where at least 50% of its shares are held by foreign shareholders, foreign incorporated companies and Singapore branches of foreign companies whose management is typically situated overseas, they can still qualify as a Singapore tax resident, provided they meet certain criteria as stipulated by IRAS. A comprehensive snapshot of IRAS’ requirements is set out in the table below:

| Type of Company | Criteria |

| Foreign-owned investment companies |

|

| Foreign incorporated companies |

|

Once IRAS has approved the company’s application, a COR will be issued to certify that it is a tax resident in Singapore.

What purpose does a COR serve?

As the term implies, a COR is an official document that companies can use to certify that they are tax residents in Singapore, which will allow them to apply for treaty benefits that are applicable under the relevant DTA. Do note that different DTAs will provide for different benefits, e.g. some countries may require companies engaged in certain industries to meet certain criteria. Hence, it may be prudent for companies to seek advice from a professional tax consultant, or read the relevant DTA in detail before venturing into the foreign market.

Companies should note that a COR is only valid in the year that it is issued, as IRAS may re-classify the company if it does not meet the stipulated requirements within the Year of Assessment (“YA”). When requesting for a COR, a company will need to provide the following information to IRAS:

- Company’s full name

- Company’s registration number

- YA for which the COR is required

Besides the information listed above, IRAS may, at its discretion, require additional information from the company.

At the moment, there is no shared electronic system through which companies can claim their tax credit, tax exemptions or tax concessions based on the DTA signed between two jurisdictions, hence the foreign tax authority will typically require a company to submit a COR as evidence, before allowing the company to enjoy benefits allowed under the DTA.

Depending on which foreign jurisdiction the Singapore tax resident is receiving income from, it may be required to submit a tax reclaim form to the foreign tax authority. This tax reclaim form may also require certification from IRAS.

In situations where a dispute or problem arises when a company is attempting to claim its tax credit, tax exemptions or tax concessions, the company should refer to the Mutual Agreement Procedure clause of the relevant DTA, which will set out the agreed upon process where companies can resolve their issues relating to the application of the DTA.

Given the hefty penalties that may arise for being non-compliant with the payment of taxes in certain jurisdictions, it would be prudent for companies to conduct adequate research or consult reliable tax specialists, to ensure that all the required documentation is prepared on a timely basis, to avoid any penalties or disruptions to business operations.

Singapore – The Preferred Gateway to Asia and Beyond

As compared to many tax jurisdictions, Singapore has one of the most attractive tax regimes. Singapore uses a one-tier tax system, meaning that one flat corporate tax of 17% is charged, instead of differential tax tiers for different sources of income. In addition, not forms of income received are taxable; and there are many tax incentives that can help a company reduce the total tax payable.

As compared to many tax jurisdictions, Singapore has one of the most attractive tax regimes. Singapore uses a one-tier tax system, meaning that one flat corporate tax of 17% is charged, instead of differential tax tiers for different sources of income. In addition, not forms of income received are taxable; and there are many tax incentives that can help a company reduce the total tax payable.

| Taxable Income | Non-Taxable Income |

Income accrued in or derived from Singapore; or received in Singapore from outside Singapore that falls under any of the following categories:

|

|

For companies that may be doing business in foreign jurisdictions where Singapore has not signed a DTA, they may be still able to claim tax credits under the foreign tax credit (“FTC”) scheme, subject to the following conditions:

- Company is a tax resident in Singapore for the relevant basis year;

- Tax has been paid or is payable on the same income in the foreign country; and

- Income is subject to taxation in Singapore

For companies that have business operations in multiple jurisdictions, the FTC pooling system is aimed at simplifying the administrative procedures for corporations. However, companies will need to fulfil all of the following conditions in order to do so:

- Foreign income tax is paid on the income in the foreign country from which the income is derived;

- The highest corporate tax rate (headline tax rate) of the foreign country from which the income is derived is at least 15% at the time the foreign income is received in Singapore; and

- The company is entitled to claim for FTC under the Income Tax Act and there is Singapore tax payable on the income.

In addition, Singapore has in place various tax incentives that companies can claim tax reliefs or enjoy concessionary tax rates on, depending on the industry that it is engaged in or if it has carried out certain qualifying activities. In particular, the Singapore government has been actively incentivising companies to invest in innovative new technologies to increase productivity and keep Singapore at the forefront of new changes and discoveries.

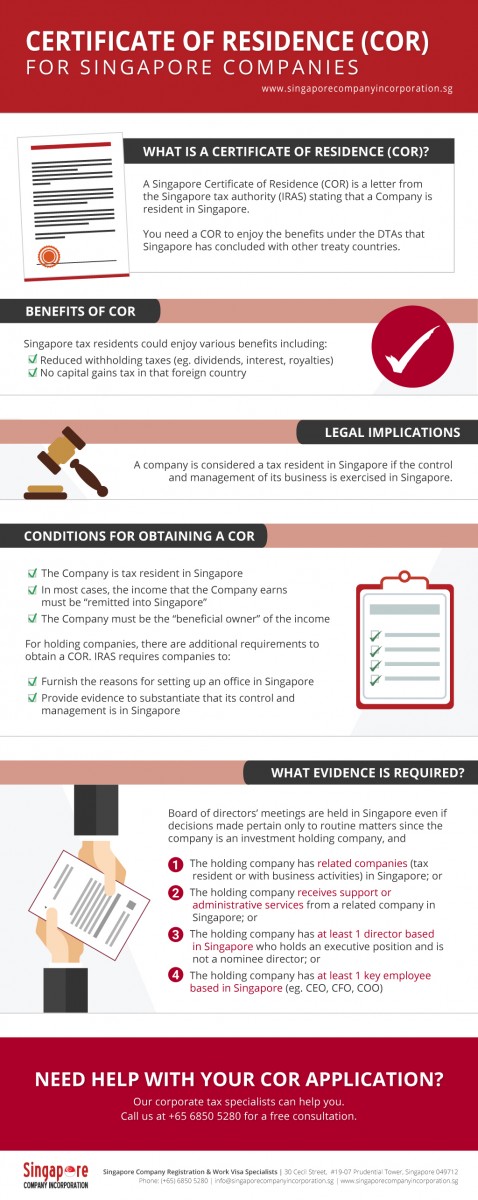

Here’s an infographic summarising what a COR is, its benefits, legal implications, conditions for obtaining a COR, and evidences required.

Need help with your Certificate of Residence (COR) application?

Register for COR with Singapore Company Incorporation, one of the leading tax agents in Singapore. Our professional taxation specialists will attend to every step of your application thoroughly.